Lost A Loved One?Finalise A Deceased Estate

Get Letters of Administration

Get Probate

Not Sure What You Need?We Can Help

Our expert team at MKI Legal can assist you with any questions about your loved one’s Deceased estate or getting your legal affairs in order before you pass away.

We Operate InSydneyAndPerth

MKI Legal has been featured in

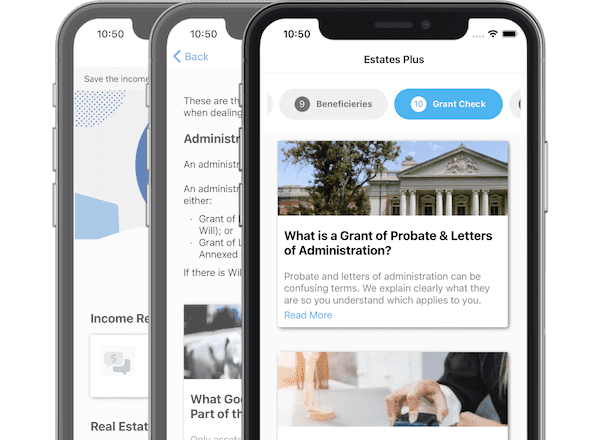

A Free App To Help With Deceased Estates

Download our free app to help you understand what to do after a loved one has died. A step-by-step guide, save estate assets, keep track of expenses and more. Written by expert estate lawyers.

Frequently Asked Questions

We’re here to help you navigate through the loss of a loved one

If a person did not leave a Will, their assets are divided between the closest family members according to a formula set by law.

Usually one or two members of the closest family members apply to the Court to get letters of administration. They are called the ‘administrators’.

Once the court approves everything, the administrators get a grant of letters of administration. This is a special piece of paper that gives them authority to legally access the deceased’s assets and information.

The deceased’s assets can then be distributed to the family members entitled to receive it.

Sometimes letters of administration is not required. We can help you find out if you need it or not.

See our Letters of Administration section for more information.

If the deceased left a Will, the executor(s) apply to the Court for probate.

Probate is the process of the Court verifying and approving the Will.

Once probate is granted, the executor(s) get a special piece of paper that gives them authority to legally access the deceased’s assets and information. The deceased’s assets can then be distributed to the beneficiaries under the Will.

Sometimes probate is not required. We can help you find out if you need it or not.

See our Probate section for more information.

A person’s estate includes all the assets and money that they owned at death. It includes assets/money in a person’s sole name and some joint property if it’s owned as “tenants in common”.

A person’s estate does not include assets held jointly with others as “joint tenants”, or assets held in a trust or generally in a super fund.