Applying For Letters of Administration In Australia

Letters of Adminisration is the process where close family members apply to the court for permission to deal with your loved one’s estate.

We Operate InSydneyAndPerth

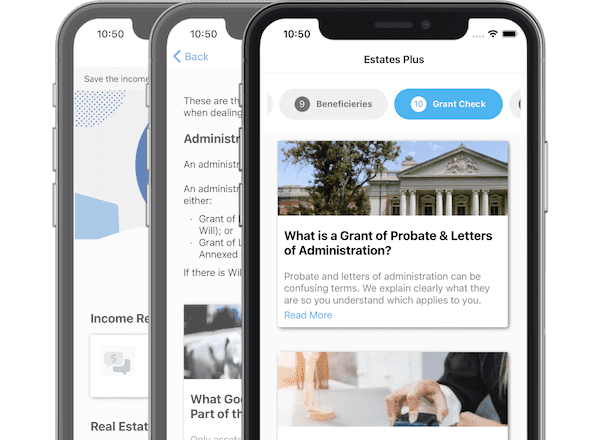

A Free App To Help With Deceased Estates

Download our free app to help you understand what to do after a loved one has died. A step-by-step guide, save estate assets, keep track of expenses and more. Written by expert estate lawyers.

What is Letters of Administration?

Letters of Administration can be described as the keys to the deceased estate if there is no Will. It gives you:

- Access to the deceased’s assets. You have the right to sell or transfer real estate, money in the bank accounts, shares, retirement bond, etc.

- Access to information held about the deceased with organisations such as super funds, retirement village bonds, ATO, banks, companies etc. After the death of a loved one, it can be difficult to get information from organisations without obtaining letters of administration.

What's The Process For Letters of Administration?

Letters of Administration applies if a loved one dies without a Will. If there is a Will, then see our Probate section.

Usually, one or two members of the close family apply to obtain Letters of Administration. However any person can apply with the close family’s permission.

The person who applies is called the “administrator”.

The Letters of Administration application is made to the Court. Once the Court approves the application, it sends an official court document (the grant of letters of administration) to the administrator. After that, the administrator gets access to the deceased’s assets and information.

The administrator then makes sure the assets are distributed to the family in the default manner set by law when someone dies without a will (called the “rules of intestacy”).

When Do You Need Letters of Administration?

Letters of Administration is not always needed. Letters of Administration is usually required if any of the following apply:

- The deceased has significant money in a sole bank account (usually $20,000 to $50,000+).

- The deceased owned real estate in their sole name or as tenants in common.

- The deceased owned significant shares in their sole name (usually $20,000+).

- An organisation such as a super fund, ATO, life insurance provider etc, requires Letters of Administration to release funds.

- You cannot cash a cheque because your bank requires Letters of Administration to be obtained (e.g a cheque for a retirement village bond).

OurLegal TeamAre Here To Help

Estates Plus is operated by the law firm, MKI Legal, so you can trust that a lawyer will be involved in the process to ensure your documents are done correctly.

MKI Legal has been featured in

Why UseEstates Plus ?

Frequently AskedQuestions

We’re here to help you navigate through the loss of a loved one

Once the documents are lodged with the Court, it usually takes 3 to 6 weeks for the Court to review and approve your documents.

These time frames are estimates and there could be delays depending on how busy the court is and if the court has further questions (called requisitions).

Yes. Once you have approved the final version of the documents, we can post them to you (at no further charge).

Yes, once you get the grant documents (e.g probate or letters of administration), you have the right to be reimbursed for your out-of-pocket expenses such as our fees and the court filing fees.